does fl have real estate tax

The decedents assets subject to tax are their taxable estate or the gross estate The federal estate tax rate starts at 40. State law grants several thousand local governmental districts the power to levy real estate taxes.

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

This equates to 1 in taxes for every 1000 in home value.

. Taxes on each parcel of real property have to be paid in full and at one time except for the installment method and homestead tax. According to section 193155 FS property appraisers must assess homestead property at just value as of January 1 of each tax year. Posted 19 hours ago.

No portion of what is willed to an individual goes to the state. Florida residents may still pay federal estate taxes. There is no personal income tax in Florida.

On average the Florida property tax rate sits at 083 with homeowners paying an average of 2035 in property taxes every year. Property taxes apply to both homes and businesses. Since Key West is in Monroe County you would be paying the non-Miami-Dade tax rate listed above.

This is comparatively lower than the national average of. Everything You Need to Know - SmartAsset There is no estate tax in Florida as it was repealed in 2004. In the year after the property receives the homestead.

Florida real property tax rates are implemented in millage. Floridas average real property tax rate is 098 which is slightly lower than the US. The exact tax rate youll end up paying depends on several factors.

Estate Tax Florida also does not assess an estate tax or an inheritance tax. Florida real property tax rates are implemented in millage rates which is 110 of a percent. As you may know Florida is a popular destination for retirement because it has no state income tax but unless you plan on renting all throughout your retirement you wont be.

What taxes do you pay in Florida. Aleiviating the Taxes and LLC. Florida property owners have to pay property taxes each year based on the value of their property.

Florida does have a. How Does Florida Real Estate Tax Work. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

A tax is also levied. Florida Estate Tax. This means that seasonal residents as well as those.

Average mill rate is 107 so. If you sold a home at the median sale. I reside in a state that HAS state income tax however I have rentals in FL and.

There is no Florida capital gains tax but you still have to pay federal taxes if you sell a home in the state. The average Florida mill rate is 113 meaning that the value of your property will be multiplied by this factor to arrive at your annual property tax bill. Discounts are extended for early payment.

Florida does not have a state income tax. Most often the taxes are collected under one. The average Florida homeowner pays 1752 each year in real property.

Florida property and sales tax support most state and local government funds since the state does not charge personal income tax. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Florida sales tax rate is 6.

The taxable estate includes assets owned either. A stamp tax of 70 cents per 100 of value is assessed on documents that transfer interest in Florida real estate such as warranty deeds and quitclaim deeds. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

The median sale price in Key West is 716135. Intangibles Tax Floridians no longer need to pay taxes. Counties in Florida collect an average of 097 of a propertys assesed fair.

Homestead Exemption Attorney Miami Martindale Com

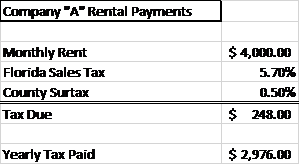

How To Calculate Fl Sales Tax On Rent

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc

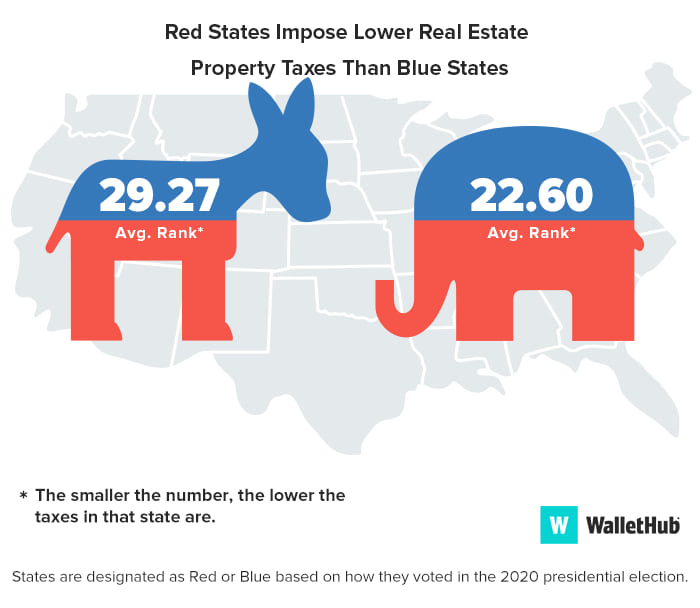

Comparison Of Real Estate Taxes For 2021 Live South Florida Realty Inc

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Florida Property Tax Calculator Smartasset

Florida Property Tax Appeals Challenge And Reduce Your Tax Liability

What Is A Florida County Real Property Trim Notice

Real Property Tax Howard County

Florida Real Estate Taxes What You Need To Know

Florida Real Estate Taxes And Their Implications

Florida Dept Of Revenue Property Tax Data Portal

Property Values Are Up So What About Taxes Florida Realtors

Palm Coast Flagler County Florida Flagler County Property Taxes Vs The Rest Of Florida

Tax Implications Of Canadian Investment In A Florida Rental Property

Estate Tax How Does It Affect Me Florida Estate Planning Florida Probate Florida Real Estate Florida Bankruptcy And Tax Attorneys

The Cost Of Paradise We Pay Much More In Taxes To Live In South Florida Sun Sentinel